Tax Consulting Services

Reverse Audit Refund Claims

Reverse audits provide businesses with internal reviews of sales and use tax determinations and procedure evaluations to detect overpayments. The best way to identify and recover overpaid taxes, as well as learn how to stop the overpayment cycle, is to conduct these reviews.

Use Tax Accruals Prep and Analysis

Numerous businesses might admit that their use tax accrual procedures fall short of expectations. Audits are increasing during a time when state budgets are tight. This combination is a vulnerability for numerous businesses. Affeldt Consulting will discuss common exposures in use tax accrual and provide general strategies for improvement that will benefit businesses across industries.

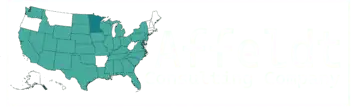

Nexus Studies and Collection Requirements

Nexus describes the degree of connection between a taxing jurisdiction and a business like yours. There is no uniform definition of nexus among the fifty states. As a criterion for determining nexus, the majority of states have established a threshold of $100,000 in sales or 200 transactions. If you have created Nexus in a state, whether intentionally or unintentionally, you are subject to some very strict obligations.

Numerous specifics, timelines, quirks, and state-by-state peculiarities are involved. 1. The gross sales from the sale of taxable items delivered in this state exceed $100,000; or 2. The seller has sold taxable items for delivery in this state in 200 or more transactions. “Having a representative, agent, salesman, canvasser, or solicitor operating in this state under the retailer’s or its subsidiary’s authority, whether temporarily or permanently.”

Procurement Cards (P-Cards)

P-cards are also referred to as purchasing cards. A credit card that many businesses use to spread out orders of smaller amounts in order to increase efficiency. While it expedites everything, many businesses will overlook tax exemptions; this is where we come in and go over each and every one to ensure we are maximizing your returns.

Pedimentos (U.S./ Mexico Border Crossing Issues)

If you are a US-based company with operations in Mexico, you most likely use a border-crossing agent to get your shipments through customs on a regular basis. Many of your suppliers may charge Texas or another state’s sales tax on goods bound for Mexico. We will assist you in reducing taxation by locating and providing pedimentos generated for custom purposes. We have ten years of experience and might be able to assist you.

Audit Defense

We represent the auditing client against the auditing state. State of Minnesota performed an audit of Polaris Industries. We review and respond to the auditor working on the case, providing explanations and legal justifications for why the specific invoice transactions should not be taxed and assessed in the audit. In addition to representing clients during the audit process, we also file Protests or Appeals against incorrectly assessed taxes or refunds that have been wrongfully denied.

Utility Studies

Sales tax exemptions on the purchase of utilities such as natural gas and electricity can be one of the largest sources of tax savings for manufacturers, processors and fabricators. Affeldt Consulting conducts utility exemption studies to support claims for sales tax exemptions by businesses in a variety of industries. This tax exemption can result in annual tax savings of hundreds of thousands of dollars.

Nexus Registration Services

Nexus Registration can be difficult, but it need not be. Allow us to handle all of your registration needs and set up your company so that you can save more money.

Managed Services

By outsourcing their entire sales and use tax department to us, clients have realized significant cost savings. We take care of everything, including compliance use tax assessment as well as recurring issues.

Minnesota Qualified Data Center applications and refund claims

If you have a large data center and use a Co-location data center in Minnesota, you may be eligible for a refund. Minnesota currently provides sales tax breaks to qualifying data centers. One of the largest privately owned data centers in the state, as well as several clients who use Co-location data centers, are among our clients. Let’s talk about your situation and see what options you have.

Regardless of the type of service we provide, our goal remains the same. To maximize refunds while maintaining high levels of customer satisfaction.